illinois payroll withholding calculator

2022 Federal Tax Withholding Calculator. Illinois Hourly Paycheck Calculator Results.

Il Calculating Child Fill Online Printable Fillable Blank Pdffiller

All Services Backed by Tax Guarantee.

. To change your tax withholding amount. Carol Stream IL 60197-5400. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State.

You may pay up to 050 less an hour for your new hires in their first 90 days of employment. Tax withheld 0495 x wages line 1 allowances x 2375 line 2 allowances x 1000 number of pay periods. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

In 2022 the illinois state unemployment insurance sui tax rate will range from 0725 to 71 with a maximum taxable wage base of 12960. Use your estimate to change your tax withholding amount on Form W-4. The results are broken up into three sections.

16 days until Jan 1. Paycheck Results is your gross pay and. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Or keep the same amount. Get Started With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Your employer will withhold money from each of. Illinois child support payment information. Ad Process Payroll Faster Easier With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. 2022 Federal Tax Withholding Calculator. This is a projection based on information.

Enter your new tax withholding. The calculator on this page is provided through the adp. Just enter the wages tax withholdings and other information required.

Supports hourly salary income and multiple pay frequencies. Manage A Global Workforce W SAP SuccessFactors Flexible Solutions For Core HR Payroll. Free for personal use.

On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. SERS Contact Information 2101 S. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Illinois State Disbursement Unit. This calculator is a tool to estimate how much federal income tax will be withheld. Remit Withholding for Child Support to.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. This is a projection based on information you provide. This applies to workers over the age of 18.

Illinois Hourly Paycheck Calculator. This free easy to use payroll calculator will calculate your take home pay. 2022 Federal Tax Withholding Calculator 2022 Federal Tax Withholding Calculator.

If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Affordable Easy-to-Use Try Now. Below are your Illinois salary paycheck results. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you. The calculator on this page. Instead you fill out Steps 2 3.

Ad Find 10 Best Payroll Services Systems 2022. Get Started With ADP Payroll. Free Federal and Illinois Paycheck Withholding Calculator.

Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. Ad Reduce Costs By Harmonizing Processes On A Single Payroll System. This is a projection based on information you provide.

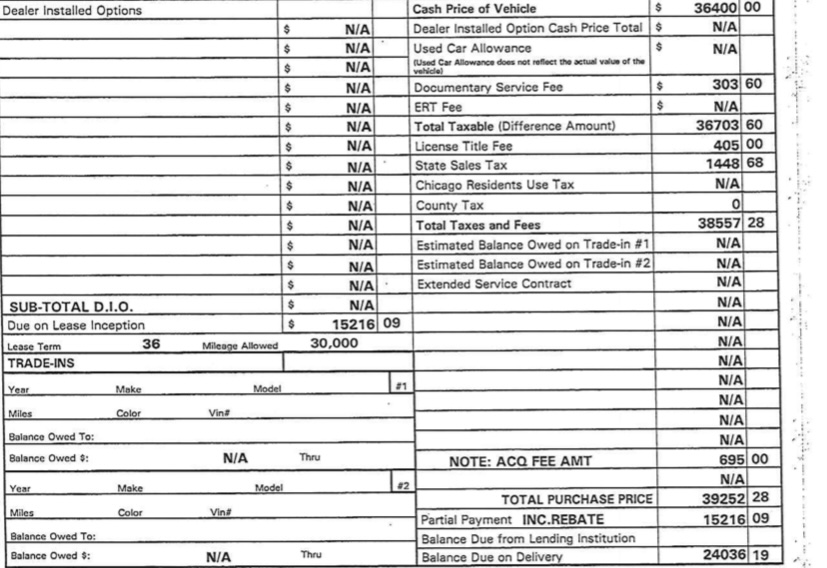

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

Illinois Paycheck Calculator 2021 2022

Illinois Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Illinois Income Tax Calculator 2021 2022

Payroll Software Solution For Illinois Small Business

Paycheck Calculator Take Home Pay Calculator

2 My Paycheck My Future Self Portfolio

The Caucus Blog Of The Illinois House Republicans Calculating Estimated State Taxes During Covid 19 Pandemic

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

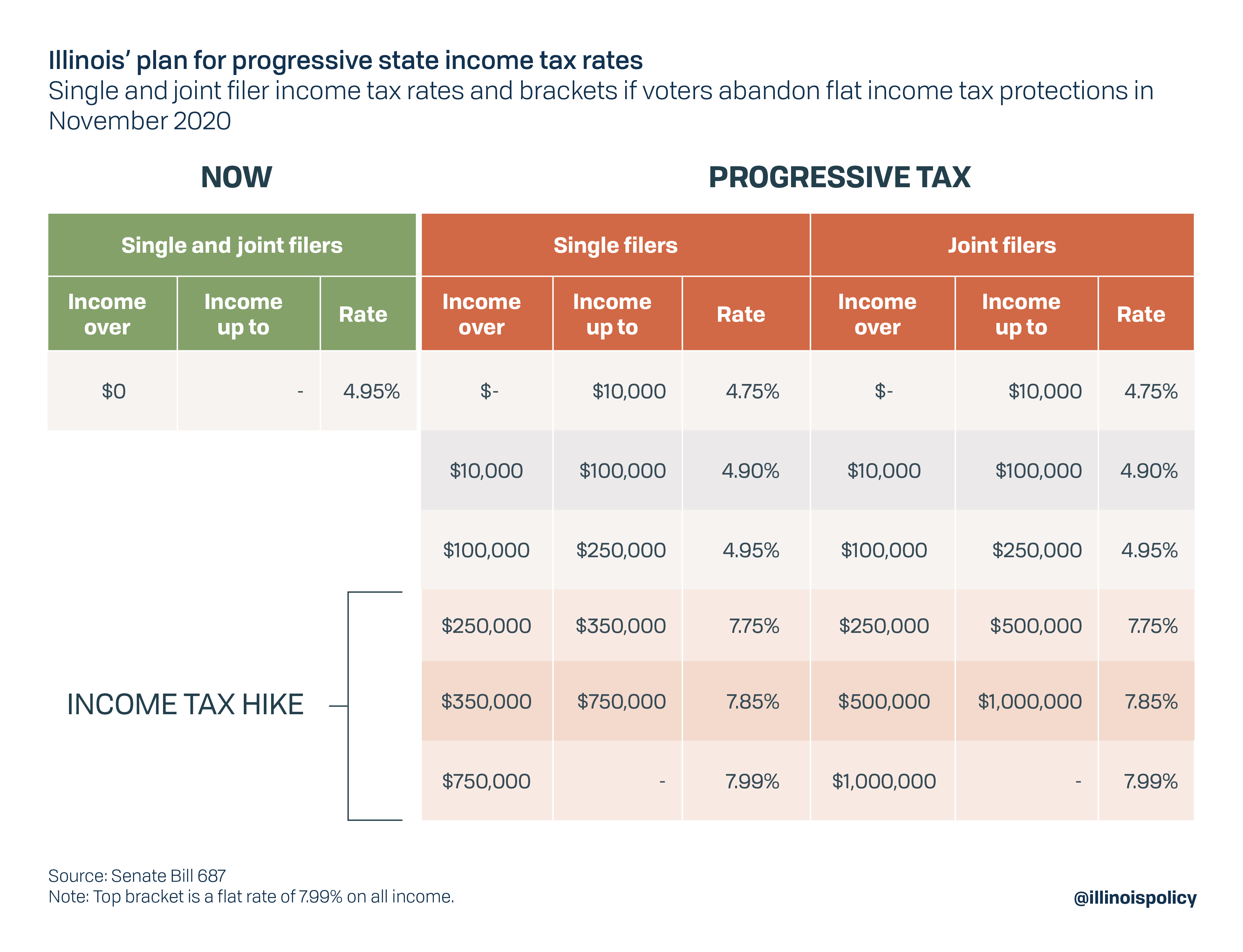

Progressive Income Tax Study Guide

Illinois Paycheck Calculator Smartasset

What Is A Fair Tax For Illinois Seiu Local 73

Destination Based Sales Tax Assistance Effective January 1 2021 Sales Taxes

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

Irs Withholding Calculator Illinois Society Of Enrolled Agents